In Law In Cabo we know that every company, when developing its economic activity, is in the obligation to comply with the legal dispositions that in fiscal accounting matters have been defined by the country where it is established.

There are different types of accounting and it is through fiscal accounting that companies are able to generate the financial reports inherent to their activity. It is on the basis of these reports that the competent authority will subsequently determine the company’s tax obligations.

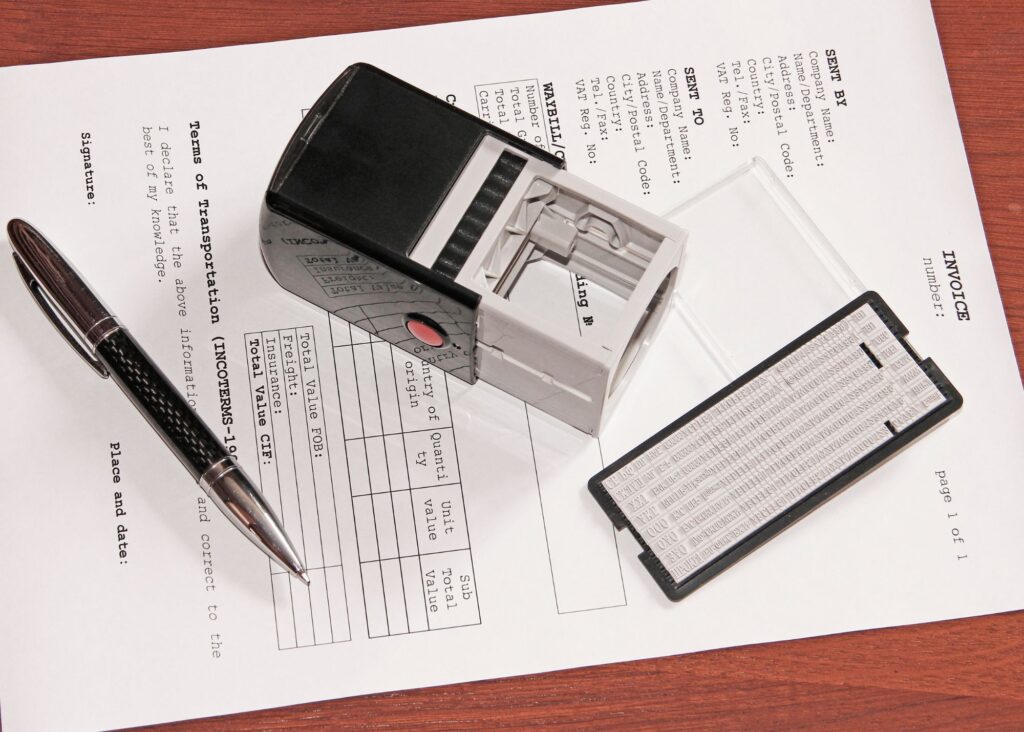

Tax accounting consists of keeping a record of the financial operations of an entity, so that it can file the corresponding returns that will result in the calculation of taxes payable. Its starting point is the tax regulations established by the law of each country.

Optimizing your taxes in compliance with the law, is the best summary we can give you about the benefits of tax accounting, called by some “tax engineering”.

Raquel Buenrostro herself, head of the Tax Administration Service (SAT), recognized this when she said recently that: “you must have a master’s degree in taxation to read all the laws and make the most of deductions”.

Tax accounting

And the fact is that beyond preparing the company for the tax return, tax accounting is governed by the laws in this area to deploy a set of methodologies that allow you to:

- Optimize tax assets or deductions and exemptions.

Facing the tax miscellaneous 2022, we dedicate this installment to rescue the advantages of tax engineering, both for business growth and for the culture of legality in our country.

The best preparation before the SAT

Those who implement tax accounting principles in their business are always in the front line regarding the changes or updates that the law imposes, such as the promises of the new Simplified Trust Regime and other changes proposed in the Fiscal Miscellaneous of 2022.

This is a tool that seems to be only available to large companies, as reiterated by the head of the SAT:

“…Burdamente encontramos que los grandes contribuyentes son los que menores tasas de ISR sobre ingresos brutos pagan; es decir, mientras menos ingresos tienes, tu tasa es más alta”, dijo Raquel Buenrostro durante un evento de Expansión, a mediados de septiembre de 2021.

Tax accounting

One word explains it all: ignorance. Micros, SMEs and unsuspecting individuals are the ones who end up paying more taxes by not taking advantage of the benefits that the laws themselves grant in tax matters.

What is tax accounting?

We can offer you a definition of tax accounting, making analogy to three of the fundamental branches of accounting: financial, administrative and tax. As Experto PYME points out:

Administrative accounting is the accounting branch that is based on the recognition, recording, classification, summary and presentation of all transactions of a business or entity, as an input for internal users in decision making.

Financial accounting is the area that focuses on the recognition of cash inflows and outflows in an organization, and how they impact cash flow and the ability to honor commitments. It focuses on external users, such as potential creditors, investors, suppliers, business partners and customers.

Tax accounting is the branch of accounting that emphasizes the recognition and control of all items that impact a business’ tax bill.

Therefore, the emphasis of tax accounting is to recognize, evaluate and monitor any transaction that influences tax payments to a greater or lesser extent.

Tax accounting

In compliance with the laws on the subject, as well as the line of business or activity of the company, the tax accountant seeks to deploy the necessary practices to optimize the so-called tax assets (deductions, exemptions) and mitigate tax liabilities (tax obligations).

As we have already said, the main user of tax accounting is the government, through the SAT.

What does the tax accountant do for your company?

As you may have noticed from the introduction, transparent and orderly tax accounting is the basis for business taxation and goes beyond.

Continue reading here: https://lawincabo.com/benefits-of-tax-accounting-mexico/

Tax accounting